The PFIC Default Regime

How the IRS Back-Taxes You Into Oblivion

This is Part 3 of a focused guide on PFICs, Form 8621, and U.S. tax traps for global investors.

Part 1 . Part 2. Part 3 . Part 4 . Part 5 . Part 6 . Part 7 . Part 8

If this applies to you or someone you know - subscribe to get the rest of the series - before the IRS catches up.

Overview

If you own a foreign mutual fund or ETF and haven't made any special tax elections, you're likely subject to the PFIC Default Regime, also known as Section 1291. This is where most people get hurt—and often don’t realize it until it’s too late.

This article breaks down how this regime works, why it’s so harsh, and how easily you can fall into it.

What Is the PFIC Default Regime (Section 1291)?

The default regime kicks in if you:

Own a PFIC

Have not filed Form 8621

Have not made a Mark-to-Market (MTM) or Qualified Electing Fund (QEF) election

In this case, any gain you realize on selling or receiving income from the fund is treated as if it was earned evenly over all the years you’ve held it while being a U.S. tax resident.

Each year’s portion of the gain is:

Taxed at the highest applicable marginal rate for that year

Charged interest for the delay in paying that year’s tax

This is called the lookback rule, and it’s what makes Section 1291 especially brutal.

What Triggers the Tax?

Sale or redemption of the PFIC

Excess distribution (a dividend larger than 125% of the average of the last 3 years’ payouts)

Even if you haven’t sold the fund, a single large dividend can trigger Section 1291 and start the IRS lookback clock.

The PFIC Tax Trap: A Real Example (Including State Taxes)

Let’s say you bought a foreign ETF while living abroad — for example, an Indian ETF like NIFTYBEES — in 2018 while you were living in India (this applies to any mutual fund/ETF not listed in the US - e.g. listed in UK, China etc).

You later move to the U.S. and become a tax resident in 2020. Years later, you sell the ETF for a profit.

The Setup

You bought the foreign ETF in 2018.

Became a U.S. resident in 2020.

Sold the ETF in 2025 for a $24,000 gain (based only on the value increase since you became a U.S. tax resident).

You never filed Form 8621 or made any PFIC elections (like QEF or mark-to-market).

Because you didn't make any election, the IRS applies the default PFIC rules under Section 1291.

How Section 1291 Works

Under the default PFIC regime:

The IRS spreads your $24,000 gain evenly across each year you held the ETF as a U.S. resident — in this case, 6 years (2020–2025).

That means $4,000 of gain allocated to each year.

For each year:

The IRS applies the highest marginal tax rate in effect for that year (typically 37% or higher).

Since you're only reporting the gain now (in 2025), the IRS also charges interest for late payment on the taxes that would have been due in prior years.

Federal Tax Calculation (Approximate)

Federal tax at 37%:

$4,000 × 37% = $1,480 per yearTotal federal tax over 6 years:

$1,480 × 6 = $8,880IRS interest charges for late payment (assuming ~4% underpayment interest averaged over time):

Roughly $1,200 to $1,400 total interest (depending on IRS rates and timing).Total federal PFIC tax bill:

~$10,000 to ~$10,300 on the $24,000 gain.

State Tax (California Example)

California taxes this income as ordinary income, fully conforming to federal PFIC treatment:

CA state tax:

$24,000 × 13.3% (top CA rate) = $3,192

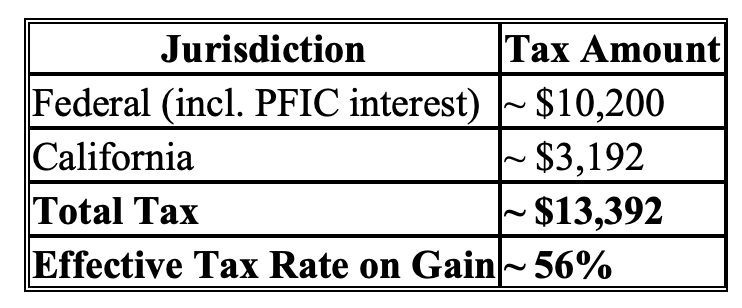

Total Tax Impact

Why It’s So Punitive

Backdating + highest marginal tax rate = inflated bill

Interest clock starts from the year you became a U.S. resident

No ability to offset with capital losses

No benefit for holding long-term

In contrast to U.S. funds (where long-term gains are taxed at favorable rates and reported annually), PFICs under Section 1291 are essentially penalized for being ignored.

What If You Already Triggered It?

If you’ve sold a PFIC or received a large dividend without proper elections, there’s no undoing it. You’ll need to:

File Form 8621 for the triggering year

Calculate the lookback and interest (often using software or a PFIC specialist)

Pay the tax + interest

You can’t retroactively elect MTM or QEF for past years.

Coming Next Week:

How to Avoid PFIC Pain: Elections That Save You Thousands

What is a Mark-to-Market (MTM) election?

What is a Qualified Electing Fund (QEF) election?

When and how to make these elections

Who qualifies and who doesn’t

This is Part 3 of a focused guide on PFICs, Form 8621, and U.S. tax traps for global investors.

Part 1 . Part 2. Part 3 . Part 4 . Part 5 . Part 6 . Part 7 . Part 8

If this applies to you or someone you know - subscribe to get the rest of the series - before the IRS catches up.